FintruX : MAKING UNSECURED LOANS HIGHLY SECURE

FintruX is a blockchain based online ecosystem connecting borrowers, lenders, and rated service agencies. FintruX facilitates marketplace lending in a true peer-to-peer network to ease the cash-flow issues of small businesses and startups.It is Global P2P Lending Ecosystem Powered By Ethereum And No-Code Development.

What are the Issues with existing lending financial system or What led to the emergence of FintruX ?

Issues Plaguing in Traditional Financing has led to the emergence FintruX the Global P2P Lending Ecosystem .Our Traditional System of Financing has lots of Anomalies.Some of these that are easily visible

Issues Plaguing in Traditional Financing has led to the emergence FintruX the Global P2P Lending Ecosystem .Our Traditional System of Financing has lots of Anomalies.Some of these that are easily visible

- Lots of Intermediaries : Most financing is still originated via third parties such as brokers and other intermediaries. They sell their contracts to banks or originators who have credit lines obtained from banks.

- Fragmented and Inconsistent : Most systems employed are not fully automated, records are mutable, censored, and subject to the patriot act of the country of domicile. Currently, the different parties would store their own copies of data, and process it individually.

- Labour Intensive : Most financing contracts are difficult to understand and special instructions such as refinance, prepayment, end-of-term processing, etc. are largely manually performed on spreadsheets.

- Startups and Small Businesses Underserved : There is a growing number of small businesses, especially startups, which fail to get loans from banks.The loan amount required is too small for banks to be interested in.

THE SOLUTION

The FintruX Network ( THE BIG IDEA )

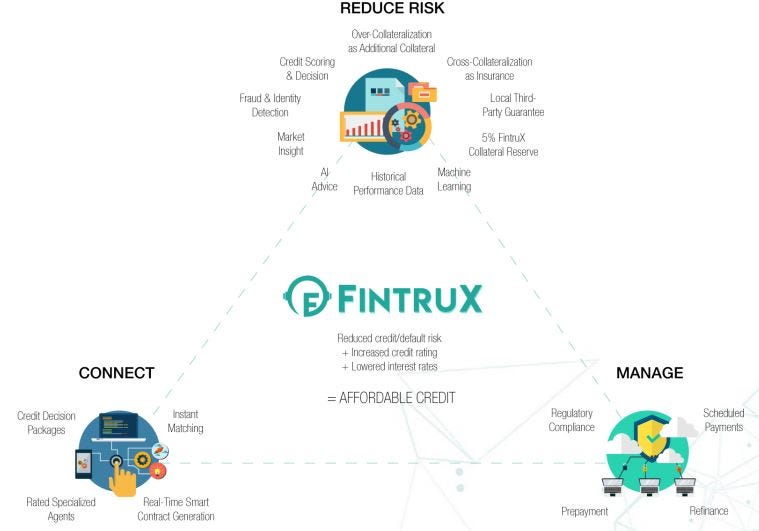

FintruX Network makes it easy for small businesses to quickly secure affordable loans with no collateral, in any currency.

The three main competitive advantages of FintruX are:

Credit Enhancements : By applying credit enhancements, FintruX Network will virtually neutralize the lender’s credit risk and, in the case of a default, provide cascading levels of insurance to cover any possible loss. With risk reduced, lenders have peace of mind and the interest rates for borrowers is lowered.

No-Code Development : A unique smart contract is automatically generated and deployed by FintruX Network for each approved loan in real-time to provide unambiguous, immutable, and censorship resistant records where no arbitration is required. This is possible with our no-code development technology.

Open Ecosystem : In addition to simplifying the loan application process via instant matching, FintruX Network also provides borrowers with post-funding self-serve administration options and access to third party rated agencies.

Tokenization : With the exception of the collateralization pools and currency being financed, inside the FintruX Network everything is tokenized.Agencies, guarantors, and FintruX Network are all being paid in FTX Token. Rewardand late charges toborrowers are paid in FTX Token as well.FintruX will continuously sell collected tokens back to the participants to finance the operation and provide liquidity.This creates a token economy for the limited

supply of FTX Token.

supply of FTX Token.

Fore More Details and ICO

Website : https://www.fintrux.com/

Telegram : https://t.me/FintruX

WhitePaper : https://www.fintrux.com/home/doc/whitepaper.pdf

BitcoinTalk Discussion : https://bitcointalk.org/index.php?topic=2286042

Posted By

Neeraj Poddar

BTC Profile Link : https://bitcointalk.org/index.php?action=profile;u=1121842;sa=summary

Comments

Post a Comment